Adaptive Asset Allocation™

THE KEY TO RETIREMENT INCOME SECURITY

History of Adaptive Asset Allocation™

In the late

1990s the Compass Institute was formed to search for a way to overcome

the flaws inherent in traditional asset allocation

investment strategies such as LifeCycle and Target Date Funds (TDF).

In the late

1990s the Compass Institute was formed to search for a way to overcome

the flaws inherent in traditional asset allocation

investment strategies such as LifeCycle and Target Date Funds (TDF).

The Institute's charter was to identify a safe, objective and repeatable approach that when consistently applied would optimize the performance of a given set of mutual funds to produce investment returns sufficient to achieve Retirement Income Security.

Specifically, the strategy they sought would both

-

Maximize returns with minimum risk in up markets, and

-

Protect value in down markets.

After 5-years of intensive research, an allocation strategy was developed and refined that would provide the desired results. That strategy was called Adaptive Asset Allocation™ (AAA).

Since 2004, public access to the discoveries and advances made at the Institute has been provided through its affiliate Compass Investors. Compass Investors offers an AAA service called HORIZON™.

These services, identical except in name, are in use across the US by

participants in employer-sponsored retirement plans at companies and

organizations including Accenture, Aon, Coca-Cola, Microsoft, University

of Michigan, and IBM, as well as by IRA and other mutual fund investors.

Complete list.

![]()

How is Adaptive Asset Allocation™ different?

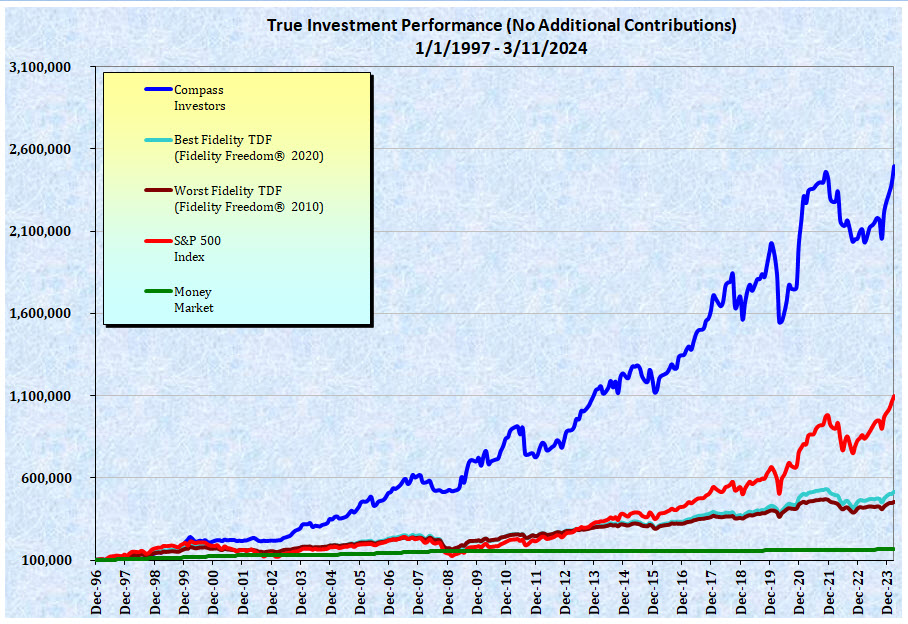

COMPASS INVESTORS HORIZON PERFORMANCE CHART

The most obvious difference, clearly seen in the chart above, is in significantly improved performance. The result of following an Adaptive Asset Allocation™ strategy results in 2-3 times more growth than the best traditional asset allocation strategy

Any AAA strategy, such as the Compass Investors HORIZON™ service, differs from traditional asset allocation in 2 fundamental ways.

- More frequent reallocation. Unlike traditional asset allocation which might realign your investments between 1 and 4 times per year, AAA reallocates your portfolio 10-11 times per year.

- Investments aligned to market conditions. Unlike traditional asset allocation which aligns asset mix according to answers to a risk assessment questionnaire, AAA aligns your asset mix according to market realities. More...

Because of these two important distinctions, AAA's superior results have been obtained with the same amount, or in many cases, lower risk than traditional asset allocation strategies.

How does Adaptive Asset Allocation™

work? ![]()